You are seeing a free-to-access but limited selection of the activity Altmetric has collected about this research output.

Click here to find out more.

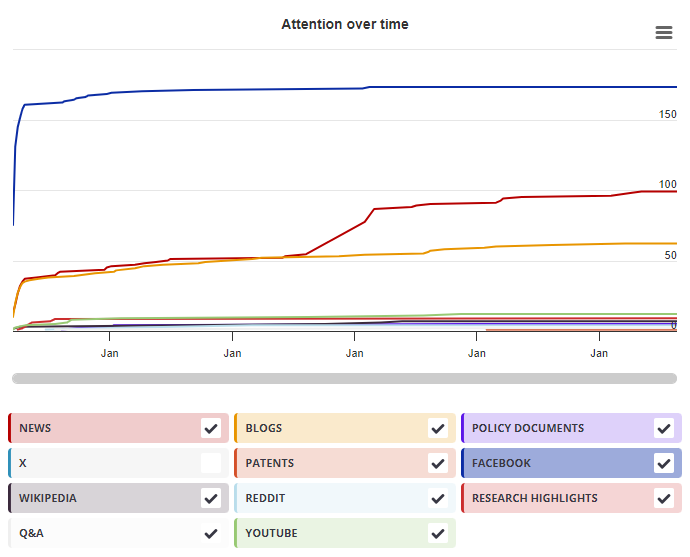

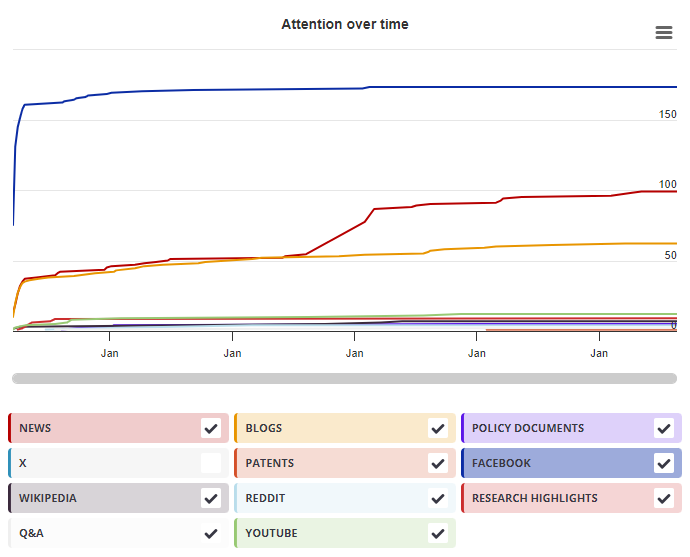

Timeline

| Chapter title |

Portfolio Volatility Contributions of Risk Factors in the Presence of Risk Factors Multi-collinearity

|

|---|---|

| Chapter number | 38 |

| Book title |

Mathematical and Statistical Methods for Actuarial Sciences and Finance

|

| Published by |

Springer, Cham, January 2024

|

| DOI | 10.1007/978-3-031-64273-9_38 |

| Book ISBNs |

978-3-03-164272-2, 978-3-03-164273-9

|

| Authors |

Mecchina, Andrea, Regolin, Enrico, Torelli, Nicola, Bortolussi, Luca |